Retail price decisions strongly influence profit margins and competitiveness for retail businesses. If your pricing strategy is not good enough, you may end up paying the price.

So an important question is: How do you calculate the retail price for your products? An advanced retail warehouse management system can provide insights to guide your pricing decisions by showing what works and what doesn’t in your pricing strategy.

Our friendly experts will be delighted to explain how WareGo can streamline your business.

Start My FREE Consultation!There is not much room for error when it comes to pricing. If your prices are even a notch higher, customers will buy from others instead of you. If your prices are too low, you will hardly make a profit.

Given the importance we attach to fair pricing as consumers, you would think that retailers have the optimal pricing strategy in place. Sadly, that is not the case.

To this day, many still don’t realize that pricing is the key driver for future profits.

As a result, a surprisingly large number of businesses lack a formal pricing strategy.

Even entities that take pricing seriously simply copy the prices of their rivals to stay competitive. This, of course, is not the most sophisticated strategy. There has to be a better way.

Table of Contents

Retail Price Strategy – Why Retailers Still Ignore It

You might marvel at why pricing strategy is still not the top priority for retailers in this day and age of ever-increasing competition.

Here are some reasons for the same:

- Back in the good old 90s, when the economy was thriving, cost reduction plans and strong demand had increased profit margins for several companies without the need for a pricing strategy. Present-day retailers are still following the laid-back pricing attitude of the 90s.

- In the past, pricing strategy was a time-consuming and costly endeavor. Hence, many businesses, especially SMEs, steered clear of this expensive process by just copying market retail prices.

- Prices are not given a very high priority during market research.

- Even for the limited pricing research that does exist, most of it is so complex that managers don’t want to grapple with its nuances.

Retailers must refine their pricing strategies to achieve maximum profitability and competitiveness. Smart pricing is now paramount for success.

Managers can start by going back to the basics. They should explore the full range of retail pricing formulas that have proven effective over time.

Doing so is far more smart than mindlessly copying the prices of market leaders.

Do remember one thing, though, before you get into it. Setting prices is just one process of price management. You should also focus on the rest of the strategy for the best results.

Hence, we will first look into basic pricing formulas before learning some of the more advanced hacks and pro-tips for effective pricing tactics.

How to Find the Retail Price

So, how to find the retail price?

The most commonly used retail price formula is based on a very simple concept. This formula is known as the “single factor cost plus model”.

You just add the required markup to the amount it costs you.

- “Markup” here refers to the extra percentage you want as profit on the sale of the item.

Far too many retailers base their markup on what the market leaders are doing. Instead of just following the leader, you should charge a markup based on your own interests.

Here are the easiest ways to calculate the actual retail price using just basic formulas.

- Retail Price = Markup + Cost of Goods

- Markup = Retail Price – Cost of Goods

- Cost of Goods = Retail Price – Markup

Basic Retail Price Formulas (with Retail Costs)

We can now explore some more advanced formulas for retail pricing (including those that factor in retail costs). While the basic price formulas mentioned above are important, you can gain further nuance with the price models shown below.

- Contribution Margin: Total Sales – Variable Costs

- Break-Even Analysis: Fixed Costs/Gross Margin percentage

- Gross Margin: Total Sales – Cost of Goods

- Cost of Goods Sold: Beginning Inventory + Purchases – Ending Inventory

- Margin %: (Retail Price – Cost) / Retail Price

- Gross Margin Return on Investment: Gross Margin $ / Average Inventory Cost

- Initial Markup: % = (Expenses + Reductions + Profit) / (Net Sales + Reductions)

- Inventory Turnover: Net Sales / Average Retail Stock

- Markup

- $ = Retail Price – Cost

- % = Markup Amount / Retail Price

- Maintained Markup:

- MM $ = (Original Retail – Reductions) – Cost of Goods Sold

- MM % = Maintained Markup $ / Net Sales Amount

- Quick Ratio: Current Assets – Inventory / Current Liabilities

- Open to Buy: (Planned Sales + Planned Markdowns + Planned End of Month Inventory) – Planned Beginning of Month Inventory

- Sell-Through Rate: % = Units Sold / Units Received

- Reductions: Markdowns + Employee Discounts + Customer Discounts + Stock Shortages

- Stock-To-Sales Ratio: Beginning of Month Stock / Monthly Sales

Drawbacks of the Average Retail Price

Basic cost-plus pricing, as well as other retail pricing formulas, were commonly used by businesses during the eighties and nineties.

Hence, these formulas have been in use for quite some time. But that has not diminished their importance even in today’s fast-paced era. In fact, they continue to be more relevant than ever.

A huge reason why they are so popular is their simplicity. Most managers don’t want advanced mathematical formulation that requires excessive time and effort. They desire something that is convenient and simple – like the formulas shown above, hence their popularity.

However, they do have their drawbacks, which need to be fully understood. Here they are as follows.

- These formulas are based on the assumption that the average retail price will remain consistently linear over time. However, the truth is that prices don’t always follow volume linearly. Plus, the total retail cost does not remain constant.

- Another unrealistic assumption is that demand remains constant with time. This simply does not correspond with real-life economics.

- They also don’t factor in nuanced information pertaining to consumers and competitors.

When using these formulas, the aforementioned limitations must be kept in mind.

So, in order to arrive at a better pricing strategy, it is necessary for any business to take the following into account.

- All its retail processes

- The organization’s capabilities and resources

- The physical requirements of the market

- The market’s psychological requirements

Advanced Retail Selling Price

Below is a simple explanation of three common retail situations, along with the most appropriate price formulas for each situation:

1. Retail Price for New Products

If you want to launch a new product, then this is what you should do:

Skim Pricing

A relatively higher price is set initially so that you can discount it over time to attract attention.

Although relatively higher, the initial price will not deter customers who are less price-conscious. These are the customers who want the product even if it means paying more.

After offering the product to this consumer segment, you can drop prices gradually to attract more price-sensitive customers.

The advantage of this approach is that a more profitable consumer segment may first buy the product at a higher price. This will improve your profit margin. When sales from this segment drop off, you can then target a tougher and less profitable consumer segment who are more price-sensitive.

Hence, you maximize sales to your most profitable customers this way and thus maintain a higher profit margin.

There is one drawback you need to consider, though. Product differentiation is crucial for success. That is, the product must have a unique and special quality that differentiates it from the rest of the market. This quality will motivate customers to buy it, despite the higher price.

Penetration Pricing

This is the opposite of skim pricing. Here, you set a relatively low price to attract consumers and bring attention to your product.

A key benefit of penetration pricing is that your new product will sell faster initially. This can be quite useful for establishing your product as the standard choice for consumers.

Penetration pricing can work for retailers who operate on a large scale, which provides cost benefits. These are called economies of scale.

Large-scale retailers can implement penetration pricing more easily because, despite the low profit margin, the high sales volume can still bring in fair amounts of total profits.

Experience Curve Pricing

Just like penetration pricing, this pricing method also requires a lower price initially for your new product. The key concept here is that with the passage of time, the product will become cheaper due to improved manufacturing methods.

As time progresses, production may get cheaper, and workers may become more efficient. The bulk purchase of raw materials may also lead to discounts. This will reduce the cost of goods produced and thus allow you to set a low price while still staying profitable.

Get your free demo to see our cutting-edge platform live in action.

Start My FREE Demo!2. Competitive Pricing

In a stable market with consistent demand, retailers can use these pricing strategies:

Leader Pricing

Also known as loss leader pricing, this strategy involves a retailer reducing prices on a few popular products to attract customers who will likely purchase other profitable items and become loyal customers. The lowered price can result in losses, but it may be worth it if the brand is able to attract more long-term customers.

Parity Pricing

The retailer will set prices that are similar to its competitors. The aim here is to compete on factors other than price, such as branding, reliability, or service quality. Since prices are regular, profit margins don’t go down with parity pricing. This method is commonly used where there is high competition and thin profit margins that don’t allow significant price reduction.

3. Product Line Pricing

Retailers who offer related services or products (for example, smartphones and phone batteries) may use these retail price strategies:

Complementary Product Pricing

While the main product itself may have a reasonable price, its accessories will carry heftier price tags.

An example of this is HP selling low-cost printers but demanding high amounts for its replacement cartridges. Another example is Apple luring customers in with its free OS, only to lock them into its ecosystem, where they have to pay high amounts for apps from the App Store.

A key assumption behind this price strategy is that consumers will find it much harder and more costly to switch to a different product, so they will tolerate pricey complementary products.

Price Bundling

Multiple related items are offered for sale to the customer at a discount that is not available if these products are bought separately.

Customers are lured to buy these bundled items since they think they are getting a good deal with the bundle discount. Hence, they often end up buying more than what they intended. This increases sales volume for the business using this price strategy.

A common example of this is fast food deals where you pay less for a burger, fries, and a drink that come as part of a deal.

Customer Value Pricing

The price set here is based on the perceived value for customers, rather than actual production costs. For example, a painting may be sold for $1 million even though its true cost is much lower. The $1 million price tag reflects the value that the customer perceives.

Advanced Retail Pricing

Retailers can use consumer psychology to price their products strategically for higher profit margins.

Here are certain well-known and widely used pricing tactics based on consumer psychology.

1. Odd-cents Pricing

Studies show that consumers buy more when the price:

Ends in an odd number. The odd numbers 5 and 9 are particularly attractive.

Ends in .99, .95, and so on.

According to some studies, consumers actually buy less if the end number is even, although the price itself may be lower. For example, customers may have a greater willingness to buy a product if it costs $10.00, but less willingness if the same product costs $9.44.

2. 9 vs 0

However, the above tactics must be used with caution in high-end markets since prices ending in 9 may signal cheapness and lower quality. Luxury products may sell more if the price ends in one or more zeroes.

3. First Figure Focus

Buyers place higher importance on the leftmost figure, which is the most significant number in the price tag. For instance, customers may have a greater willingness to buy if the price shifts from $20.51 to $20.59, but less willingness to buy if the price hike is from $39.99 to $40.01. This happens even though the former has a greater price hike than the latter. Buyers perceive that the price hike in the former is less because the leftmost significant figure did not change.

4. Price Length

Reducing the length of the price figure has a positive effect on the buying decisions of consumers. This is because they visually perceive a shorter figure length and thus a lower price impression.

For example, $1,999 seems more than $1999. That’s because the extra comma makes the former seem longer and thus bigger. Hence, removing the comma can shorten the price figure, making the price seem smaller.

Removing cents can also help for the exact same reason. Hence, $20 will seem smaller than $20.00 even though both have the same value.

5. Price Rounding

Consumers view prices in the form of ranges. This can shape their perceptions of price hikes. For example, a price hike from $3.10 to $3.50 may seem smaller than a price hike from $3.95 to $4.00, even though the former is a bigger jump than the latter. This is because in the former, prices are “3 point something” and thus remain in the range of 3. But in the latter, the number switches to 4, beyond the mental range of 3, which feels like a big jump.

6. Price Spread

A wide price spread can help you sell more. Here is how it works. Prices for a specific product type range from cheap to expensive. The expensive product is deliberately given a hefty price tag even though it has similar features and quality to midrange items. That is, the costly item is a decoy that serves to make midrange items look more reasonably priced and a good deal. Even the cheap item serves as a decoy since its low quality makes the midrange items look comparatively good.

Data-Driven Pricing Decisions

We have reviewed basic price formulas, pricing strategies, and price-based consumer psychology.

Now it’s time to explore the real game-changer for your pricing strategy, which will help you sell more with the right prices.

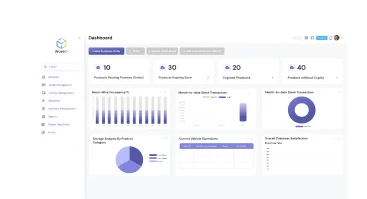

Retail management software can give you a wealth of analytics and detailed instant reports to find out what works in your price strategy and what doesn’t. This will provide you with powerful, actionable insights to boost sales volume and increase profit margins.

Our friendly experts can outline in simple words how WareGo helps.

Chat With Us!And while prices strongly influence customer buying decisions, let’s not forget the great importance of reliable service quality.

For example, you will want to have enough stock at hand to avoid disappointing your customers with stockouts.

But there’s a catch.

To avoid stockouts, you can easily go the other extreme and end up with excess stock, unsold goods, and high holding costs.

Once again, retail management software can come to the rescue. It avoids stockouts with automated reordering, timely alerts for low stock, and real-time stock visibility. It prevents overstocking with accurate AI-powered forecasts.

Furthermore, the system enhances order fulfillment and warehouse operations through inventory management features such as ABC classification, serialization, and slotting, which enable faster picking and reduced worker travel times.

Built-in support for barcode/RFID scanning heightens productivity and reduces costly errors.

Integration and automation features minimize manual work, thereby reducing errors and delays, which in turn improve your service quality.

There are many more features in our next-gen retail management system that empower you to strongly enhance both your pricing strategy and service quality.

Bottom Line

A powerful retail management system greatly simplifies basic price formulas, strategies, and consumer psychology, which are paramount for devising an intelligent pricing strategy that really works. However, you will need a powerful retail management system to understand how well your pricing works. The system is also necessary for improving your service quality via inventory and order management.

Hence, WareGo can revolutionize not just your pricing, but your entire retail strategy.

Is WareGo the right fit for your business? Find out with a 100% FREE trial.

Start My FREE Trial!FAQs

What is the retail price?

The retail price refers to the final amount that the end user or customer must pay to own the item. The amount includes both the profit margin and taxes.

Retailers purchase products at wholesale prices from manufacturers or distributors. They add an amount called markup (the profit margin) and taxes to this cost to obtain the retail price.

What does RRP mean?

RRP is an abbreviation for “recommended retail price”. This is the recommended retail price for the product, as specified by the manufacturer.

Other names for the RRP include

- Manufacturer’s suggested retail price or MSRP

- Suggested Retail Price (SRP)

- List price

Retailers are not legally bound to sell at the RRP. This amount just serves as a benchmark to make price comparisons between different sellers.

What is an example of retail pricing?

Charm pricing is an example of retail pricing where the price has either a .99 or .95 at the end of the price. For example, a t-shirt priced at $19.99 seems cheaper than one priced at $20. Additionally, such pricing signals a bargain, as these prices often originate from sales and promotions.

How to calculate a retail price?

The cost-plus markup method is the most common way of calculating the retail price. To the original cost of producing or acquiring the product, a certain percentage, known as the markup (or profit margin), is added. Taxes are also added. The result is the retail price.